RF Outstanding Check Register Report

Content

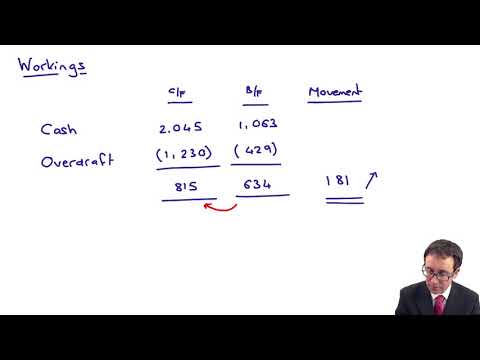

From there, open the last Outstanding Check List report. After checking the date, and still the issue persists, we can perform some troubleshooting steps to fix this. There are times that the browser is full of frequently accessed pages, thus causing some unusual responses. Let’s log in to your account using a private browser. It does not change to “Uncleared” even after I select it from the drop down menu. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations.

- Are you struggling to get customers to pay you on time, or…

- To avoid this, use the check reversal function to ensure the reversal and the original entry have the same number.

- This type of property is often handled by a paying agent, but the hospital is responsible to ensure it is reported as unclaimed property.

But it will still list the check on the “uncleared list”. I am guessing you would have reconcile the bank account. Checks that remain outstanding for long periods of time cannot be cashed as they become void. Some checks become stale if dated after 60 or 90 days, while others become void after six months. If you don’t account for outstanding checks properly, then you risk spending the money for the check on something else. This could result in a “bounced check”, and you may be charged a “non-sufficient funds” fee by your bank.

Outstanding Checks Report

With banking activity becoming increasingly electronic, another way to avoid writing a check and forgetting about it is to use the checking account’s online bill pay service. This should provide real-time information about the total dollar amount of checks outstanding and the total dollar balance present in the account. Individuals need to account for outstanding checks when they balance their checkbooks. When you write a personal check, you should record the date, check number, payee, and amount in your check register. This is very important because your bank balance will be higher than your available funds until the check clears the bank. Recording it in your register right away reminds you that those funds are earmarked for that check. Outstanding checks remain unclaimed for 3 or more years will become part of the city’s annual escheatment process.

God Of War Ragnarok Takes Home Multiple Gongs At DICE Awards … – PlayStation Universe

God Of War Ragnarok Takes Home Multiple Gongs At DICE Awards ….

Posted: Fri, 24 Feb 2023 12:49:36 GMT [source]

This list includes o/s checks from the prior month and all checks written for the current month also. We even push in our bank transactions – it will match to the check.

Terms Similar to Outstanding Check

ASCII can be easily pulled into a spreadsheet or word processor. Thanks for following this thread, @seashell509. I’ve got you the steps to print uncleared or open transactions in QuickBooks Online. Since there’s not a direct way of exporting the transactions directly to Excel, you may want to consider using a file converter to assist with the conversion process. The Intuit Marketplace is a one stop shop where you’ll find third-party applications that integrates with QBO. This has vastly discouraged me from continuing to use quickbooks or any other intuit products.

What is an outstanding check list?

The definition of an outstanding check is a check that has been written, but it hasn't been cashed-deposited by the bank, or otherwise cleared the bank. An outstanding check can be a personal or a business check.

For proper aging, keep a listing of the check by payee, amount, and issue date, rather than the date removed from the bank account. Older checks may move from the top of the report to the middle, if your outstanding check report sorts by month and day but not by year. Outstanding Checks are all un-cashed disbursements issued by the City over the past three years.

Services

This may encourage them to deposit or cash the check. If they haven’t received the payment, this may nudge them to notify you to reissue the check. The definition of an outstanding check is a check that has been written, but it hasn’t been cashed-deposited by the bank, or otherwise cleared the bank.

If the outstanding check is less than six months old, you should not write another check. The original check is still valid, and the payee can cash or deposit it. It’s fine to contact the recipient after a few weeks to find out if they’ve lost the check or when they plan on cashing it.

” They do expire and that’s why it’s important to record the date you wrote the check. Now, fill in the properties of the outstanding deposit. The person or entity that the check was made out to, e.g., the supplier. Please stand by, while we are checking your browser… Outstanding Check Report, but I haven’t found the option to run that report.

Ensure https://intuit-payroll.org/roll checks are tracked using this shorter timeframe. Your system reuses check numbers before a stale-dated check is reviewed and transferred to a liability account for reporting. The earliest date you can enter is 01-JAN-01, the “go live” date for the Research Foundation’s Oracle applications. Legacy system check information is not in Oracle. The beginning date of the checks to be reviewed. Section 9.39 of the Revised Code provides that unclaimed money shall be deposited to the credit of an Agency Fund and shall be retained there until claimed by its lawful owner.